Support DeSales

At DeSales High School, teaching the young men entrusted to our care to value high standards of character, commitment, and achievement are not only the principles of our mission, they are the promises we keep and the gift we offer the Church, our community and the world beyond.

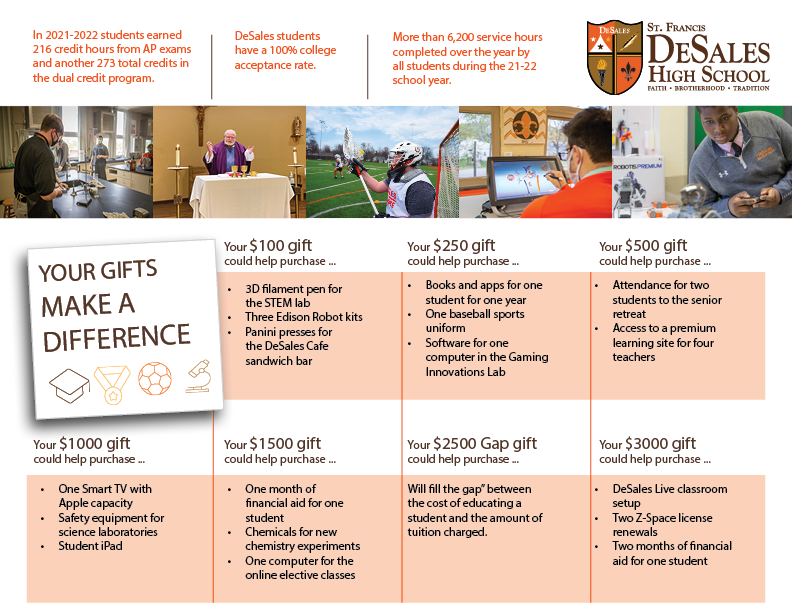

Every gift, no matter the size, provides vital support to the school and its mission. When you support DeSales High School, you invest in the potential of our students and their ability to change the world. Learn what your gift can purchase.

The Advancement Office manages all charitable giving at the school. Contributions through cash, check, credit card, appreciated stock, real estate or other charitable giving vehicles are welcomed and sincerely appreciated.

|

Making a contribution to DeSales online with a credit card is as easy as clicking the button below.

If you would like to make a gift by mail, please send to: |

- You choose how much you can afford to contribute each month

- Monthly gifts reduce the financial impact to you but has a much or an even greater impact on those we serve

- Monthly giving is available online or through bank draft for the Fr. Jude Cattelona Annual Fund and Adopt a Colt Scholarship Program. For PayPal choose "Make this a Monthly Donation," submit the monthly gift amount, and in the "Write a Note" area indicate if the gift is for the annual fund, Support a Colt Scholarship Program, or other.

- For bank draft, please contact the Advancement Office at (502) 883-2438 or download the Monthly Giving Form below and return to DeSales.

- Learn about the Circle of Brotherhood donor level achievable through a $200 monthly gift.

Many individuals choose to use a required minimum distribution (RMD) to benefit a non-profit organization through a charitable donation. A RMD is the amount of money that must be withdrawn from a traditional IRA, SEP, or SIMPLE individual retirement account (IRA) by owners and qualified retirement plan participants of retirement age. Roth IRAs do not require a required minimum distribution. Total Qualified Charitable Distribution (QCD) may be made up to $100,000 in one year.